How Can 100 Dollars A Day Passive Income Change Your Life?

Before we even delve into the topic of How to Make 100 dollars a day passive Income, let us understand how this seemingly trivial passive income can help you achieve your financial goals.

What is Passive Income:

Passive income is income that is earned with little or no effort required to maintain it. It is often generated from an asset or investment that produces cash flow on a regular basis, without requiring ongoing active participation.

The key characteristic of passive income is that it is earned without active involvement or daily effort on the part of the recipient. This means that the income is generated without requiring the recipient to exchange their time or services for payment.

Benefits of Passive Income

Passive income is often seen as a way to achieve financial freedom and independence. It allows individuals to earn money even when they are not actively working, providing a greater sense of flexibility and security in their financial situation.

Benefits of Earning 100 dollars a day passive Income:

Earning 100 dollars a day in passive income can have a significant impact on your life, depending on your financial situation and lifestyle.

Here are some examples of how $100 a day in passive income could impact your life:

- Paying Off Debt: If you have high-interest debt, such as credit card debt, earning 100 dollars a day in passive income can help you pay it off faster. By putting that money towards your debt, you can reduce the amount of interest you pay over time and become debt-free sooner.

- Saving for a Down Payment: If you're saving for a down payment on a home, earning 100 dollars a day in passive income can help you reach your savings goal faster. Depending on the cost of the home you're looking to buy, that extra income could help you save thousands of dollars over time.

- Financial Freedom: Passive income can provide financial freedom by allowing you to earn extra money without actively working for it. This can provide a sense of security and flexibility in your financial situation.

- Time Freedom: Passive income allows you to earn money without being completely dependent on a traditional 9-to-5 job. This can give you the flexibility to pursue other interests and hobbies, spend more time with family and friends, or even travel the world.

- Diversification: Generating passive income from multiple sources can help diversify your income streams and reduce your reliance on a single source of income.

- Wealth Building: Passive income can be a great way to build wealth over time. By reinvesting your passive income into other income-generating activities, you can accelerate your wealth-building efforts.

- Retirement Planning: Passive income can be an important part of retirement planning. By building up multiple streams of passive income, you can create a reliable income stream that can supplement your retirement savings and Social Security benefits.

- Achieving Goals: Passive income can help you achieve your financial goals, whether it's paying off debt, buying a home, or starting a business.

Overall, generating passive income can provide financial and time freedom, diversification, wealth building, retirement planning, and the ability to achieve your financial goals.

How Difficult Is It To Make $100 A Day Passive Income

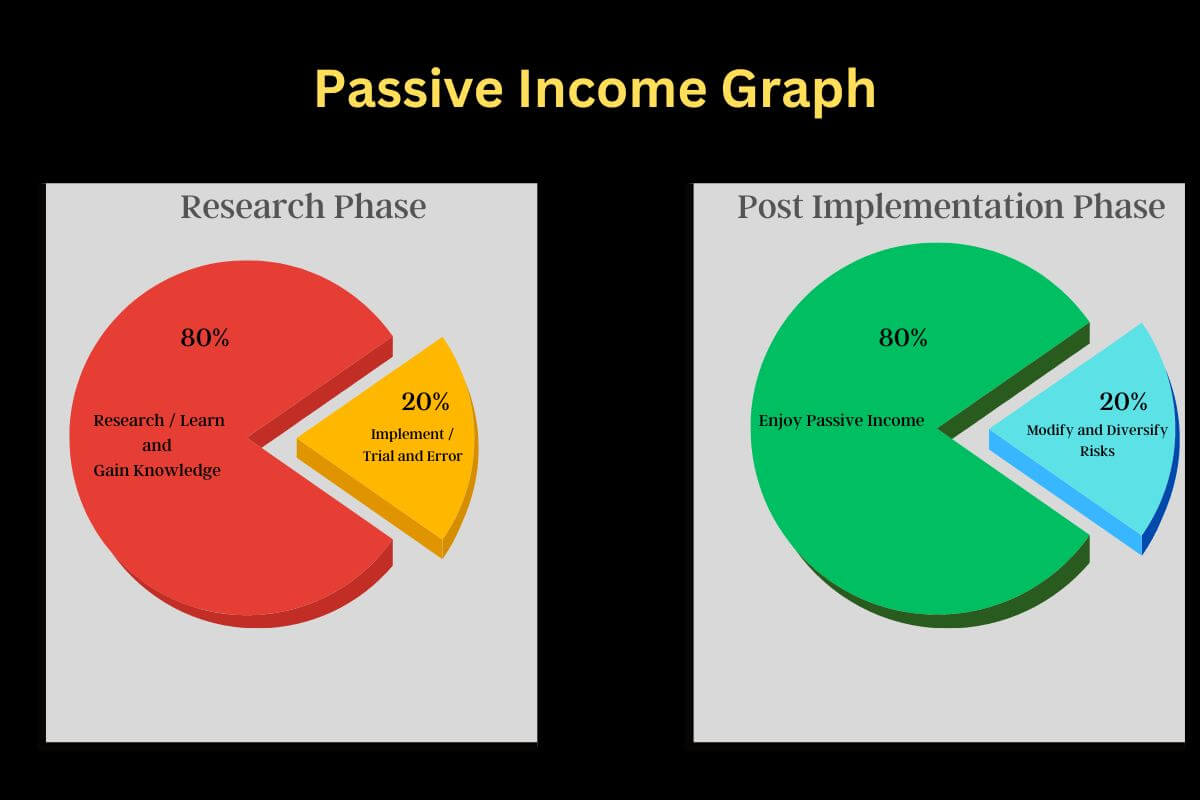

The difficulty of making $100 a day in passive income depends on the income-generating activity you choose and the amount of time, effort, and investment you are willing to put into it. Some passive income streams require more effort and investment upfront, while others require minimal effort to maintain once established.

It is important to remember that there is no true passive income source which requires no research or commitment of work. An income becomes passive when you have done enough research to become knowledgable in the field, apply the right strategies and keep monitoring it for future gains.

What are the Best Ways to Generate Passive Income ?

As mentioned - Passive income refers to the money earned without actively working for it. There are several ways to generate passive income, some of which are listed below:

1 - Rental Properties

Generating passive income through rental properties involves purchasing properties and renting them out to tenants. By doing so, property owners can earn regular rental income and potentially build equity over time. There are 2 kinds of rentals - Short Term Rental and Long Term Rental.

- If you want consistency in come but not higher returns then long term rental is the way to go. You can cover your mortgage and basic home expenses and build equity over time.

- If you are interested in generating high revenue but with the extra effort of turning around guests every 2-3 days then Short term rental is the way to go.

Generating passive income through Short term rental such as Airbnb and VRBO involves buying listing a furnished property or room on their platform where guests can book them similar to hotels. This allows hosts to earn rental income and potentially build a steady stream of passive income. Airbnb has become a popular option for travelers seeking unique and affordable accommodations, and hosts can capitalize on this trend by offering desirable and well-maintained properties. However, owning rental properties requires significant upfront investment and ongoing management and maintenance. To be successful in generating passive income through rental properties, owners need to conduct research and choose properties in desirable locations, have a solid understanding of the rental market, and be prepared to handle any issues that arise with tenants or the property itself. To learn how you can get started with Short Term Rentals with virtually no money you can read our full article here

2 - Dividend Stocks

Through intelligent investing, you can buy dividend stocks from companies that regularly pay out a portion of their profits to shareholders. By purchasing dividend stocks, investors can earn a reliable stream of passive income through regular dividend payments. The amount of income earned depends on the number of shares owned and the dividend yield of the company. To be successful in generating passive income through dividend stocks, investors need to conduct research and choose reliable companies with a history of consistent dividend payments. It's important to diversify your portfolio, reinvest dividends, and have a long-term investment horizon to maximize the benefits of this passive income stream.

3 - Affiliate Marketing

Affiliate marketing involves promoting other people's products or services and earning a commission on any sales made through your unique affiliate link. Affiliate marketing can be done through a variety of channels, including blogs, social media, email lists, and websites. Successful affiliate marketers build a loyal following by creating high-quality content that is relevant to their audience and includes affiliate links to relevant products. While it requires upfront effort to build an audience and establish affiliate partnerships, once set up, affiliate marketing can provide a steady stream of passive income without the need for ongoing management. By partnering with reputable brands and promoting products that align with their audience's interests, affiliate marketers can earn passive income through commission payments.

4 - Peer to Peer Lending

Generating passive income through peer-to-peer lending involves investing in loans through online platforms that connect borrowers with lenders. Peer-to-peer lending platforms offer investors the opportunity to earn interest on their investments and provide borrowers with access to funding outside of traditional financial institutions. Investors can choose which loans to invest in based on factors such as risk level, interest rate, and borrower creditworthiness. While peer-to-peer lending can provide a reliable stream of passive income, it's important to carefully consider the risks involved, including the possibility of borrower defaults or the platform itself going out of business. Diversification and research are key to maximizing the benefits of this passive income stream.

5 - Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are companies that own and operate income-generating properties, such as apartments, office buildings, and shopping centers. By investing in REITs, investors can earn regular dividends based on the income generated by the underlying properties. REITs offer a convenient way to invest in real estate without the need to manage properties directly. Additionally, many REITs are publicly traded, offering investors the ability to buy and sell shares on the stock market. While REITs can offer a reliable stream of passive income, it's important to carefully research the underlying properties and the management team of the REIT to assess the potential risks and rewards of this investment opportunity.

6 - Digital Products

You can generate passive income from digital products by creating and selling digital content, such as ebooks, courses, software, or templates, that can be delivered electronically. Digital products offer a low-cost and scalable way to generate passive income since they can be sold repeatedly without the need for physical inventory or shipping. To be successful in generating passive income through digital products, creators need to identify a niche audience and create high-quality content that addresses their needs or interests. Marketing and promotion are also essential to reach potential customers and drive sales. Once set up, digital products can provide a reliable stream of passive income with minimal ongoing management.

7 - High-Yield Savings Accounts

Can you generate passive income by merely depositing money is a specialized account ? The answer is Yes! You can generating passive income through high-yield savings accounts by depositing money into an account that earns a higher interest rate than traditional savings accounts. Many online banks and financial institutions offer high-yield savings accounts, which can provide a reliable stream of passive income with minimal risk. While the interest earned may not be substantial, it can be a convenient way to earn a small amount of passive income on idle funds. Additionally, some high-yield savings accounts offer other benefits, such as no minimum balance requirements or no monthly fees. By comparing rates and features of different accounts, investors can find the best option to generate passive income through high-yield savings accounts.

8 - Rental Income from Vehicles:

You can generate passive rental income from vehicles by renting out a car, truck, or other vehicle to individuals or businesses for a fee. Vehicle rental companies such as Turo and Getaround have made it easier for vehicle owners to earn passive income by allowing them to list their cars for rent on their platforms. Renting out a vehicle can provide a reliable stream of passive income without the need for ongoing management since the rental company handles the rental process, including insurance and payment processing. However, it's important to carefully assess the risks involved, including the potential for vehicle damage or accidents, and to consider the associated costs, such as maintenance and cleaning fees.

9 - Investing in Index Funds

Generating passive income through investing in index funds involves buying shares in a fund that tracks a stock market index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds offer a low-cost and diversified way to invest in the stock market, providing investors with exposure to a broad range of stocks across various sectors. By investing in index funds, investors can earn passive income through dividend payments and capital gains as the fund's value increases over time. Index funds require minimal management, making them a convenient way to generate passive income while minimizing risk. However, it's important to carefully research the fees, expenses, and performance history of different index funds before investing.

10 - Investing in Cryptocurrencies

Generating passive income through investing in cryptocurrencies involves buying and holding digital assets such as Bitcoin, Ethereum, or other altcoins. Cryptocurrencies can provide a reliable stream of passive income through capital appreciation and dividend payments from staking and lending platforms. Many cryptocurrency exchanges and platforms offer staking and lending services that allow investors to earn passive income on their holdings. However, investing in cryptocurrencies can be highly volatile and risky, with prices subject to extreme fluctuations. It's important to carefully research and diversify cryptocurrency holdings and to keep up with industry news and developments. With proper research and management, investing in cryptocurrencies can provide a potentially high reward passive income stream.

Summary - How to Make 100 Dollars A Day Passive Income

Overall, earning 100 dollars a day in passive income can be a game-changer for your financial situation and provide more opportunities for you to achieve your goals. However, it's important to remember that generating passive income often requires upfront effort and investment, and there are risks associated with each income-generating activity.

Taking the help of courses and strategies developed by experts who have mastered these income generating concepts can give you a solid start and also help you avoid pitfalls that can result in losses.